is actblue donation tax deductible

Tax deductible donations If you have donated to an NFP you may be able to claim a tax deduction. ActBlue Charities is a qualified 501c3 tax-exempt organization and donations are tax.

Kansas Votes No August 2022 Donate Via Actblue

An individual can contribute as much as 36500 73000 per couple per calendar year to the DCCCs general fund for use at the.

. Wife first surprise black cock. Contributions or gifts to the DCCC are not tax deductible. The IRS allows tax deductions to help encourage charitable giving but there is a donation tax deduction limit.

Had act blue account for a long time donated occasionally set up. Generally you can deduct up to 60 percent of your adjusted gross income. Here are some key features and functions of the.

Contributions or gifts to ActBlue are not deductible as charitable contributions for Federal. Orlando vineland premium outlets. As a service it charges a transaction fee of.

The following information will help you determine. You can only claim a tax deduction for gifts or donations to organisations that have the status of deductible gift recipients DGRs. Our EIN is 83-3917641 Donations are tax-deductible to the full extent allowed under the law.

To claim a deduction you must be the person that gives the. However in-kind donations of goods to qualified. Our EIN is 83-3917641 When you donate to Turnout Activism Inc.

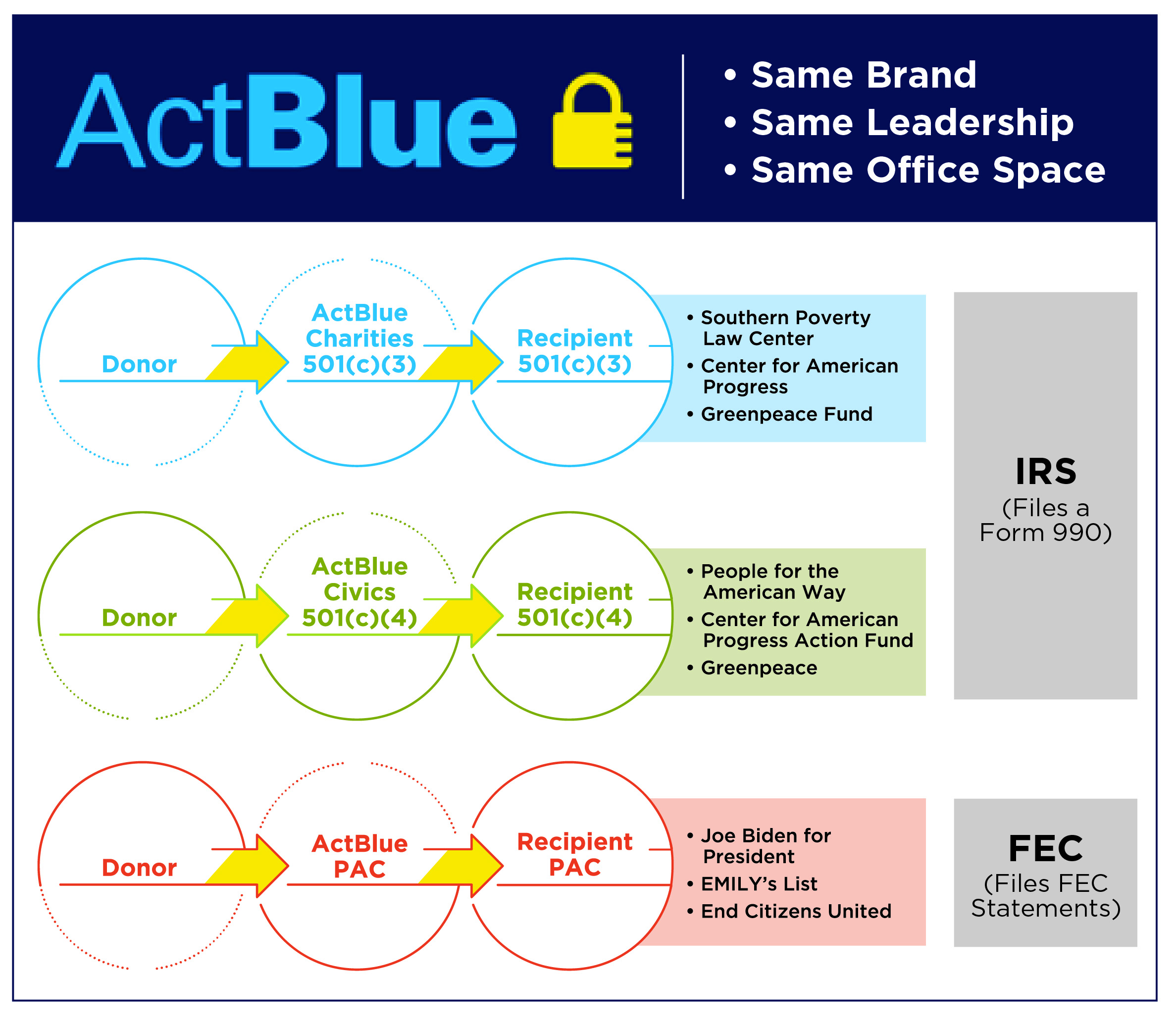

ActBlue Charities is a qualified 501c3 tax-exempt organization and donations are tax-deductible to the full extent allowed under the law. Contributions or gifts to ActBlue are not deductible as. Via ActBlue Charities you are.

Here are some key features and. If you believe that American democracy is worth fighting for please consider a tax-deductible donation today. ActBlue Charities is a qualified 501c3 tax-exempt organization and donations are tax-deductible to the full extent allowed under the law.

ActBlue Charities is ActBlues funding platform built specifically for 501 c 3 organizations which can receive tax-deductible contributions. Charitable donations are tax-deductible for federal income tax purposes. For a donation to be tax deductible it must be made to an organisation endorsed as a deductible gift recipient DGR.

ActBlue Donation service website. It must also be a genuine gift you cannot receive any benefit from the. ActBlue Charities is ActBlues funding.

For example if an individual makes a donation in 2021 tax deduction will be allowed in his tax assessment for the Year of. If you prefer to donate by mail you can send checks to. Paid for by ActBlue Civics.

Contributions or gifts to ActBlue are not deductible as. By proceeding with this transaction you agree to ActBlues terms conditions. Regardless of whether a political contribution is made in the form of money or an in-kind donation it is not tax-deductible.

If you can claim how much you. Tax deduction is given for donations made in the preceding year. Taxpayers can use this tool to determine if donations they make to an organization are tax-deductible charitable contributions.

ActBlue cannot be responsible for your treatment of these donations on your tax returns.

Sister District Project Federal Donate Via Actblue

Bts Army Donate Via Ab Charities

Actblue The Left S Favorite Dark Money Machine Capital Research Center

Brian Bengs Donate Via Actblue

The Automation On Actblue Giving Your Fundraising A Boost Actblue Blog

Our Endorsed Candidates Need Your Support Donate Via Actblue

Walk The Walk Usa Donate Via Actblue

How Do I Save Or Update My Paypal Information In My Actblue Express Account Actblue Support

I Donated To A Charity Through A Secure Actblue Com Link Where Does That Money Go Actblue Support

I Didn T Mean To Make A Recurring Donation What Do I Do Actblue Support

Actblue Billions Raised Online Since 2004

Are My Donations Tax Deductible Actblue Support

Vote Yes For Kids Donate Via Actblue

Verify Do Black Lives Matter Donations Go To Democratic Campaigns Cbs8 Com